Навигация

6 Responsibility

On general rules tax returns (calculations) are subject to presentation in tax organs in a timely manner (p. 6 item 80 NK of Russian FEDERATION), for violation of which the Internal revenue code foresees responsibility on an item 119 NK of Russian FEDERATION.

We will remind, in accordance with п. of 1 this article the size of penalty approvals can make the to 30% sum of tax from 5, to subject to payment (to the additional charge), depending on the amount of months (complete and incomplete) of expiration. If the sum of tax is small or absents quite ("zero" declaration), then from a taxpayer will exact a minimum fine - 100 rubs. In the case of delay more than on half-year (more than 180 days) into an action п. enters 2 items 119 NK of Russian FEDERATION, which more hard fines are set, namely 30% from the sum of tax, to subject to payment, plus on 10% for every month (complete and incomplete) of delay. However a minimum fine (100 rubs) this norm does not foresee, therefore if to present a "zero" declaration later 180 days from the set term, then a fine will not be in general. Undoubtedly, certain interest for a taxpayer Letter of Ministry of finance of Russia will cause from 24.12.2007 №03-01-13/9-269. In particular, in this document did officials answer a question: is it possible to attract a taxpayer, obliged to present declaration in an electronic kind (on telecommunication communication channels), to tax responsibility on an item 119 НК of Russian FEDERATION, in case if declaration was presented on a paper transmitter?

The separate categories of taxpayers according to a tax law must present declarations (calculations) in an electronic kind. This duty they carry out by communication of corresponding data through telecommunication communication channels. In opinion of Ministry of finance, presentation of tax return in the improper kind or by the unstated method must be examined as a nonperformance of duty on her presentation. At the same time to bring a taxpayer to the account, handing over declaration with violation of requirements of item 80 NK of Russian FEDERATION, in opinion of officials, it is needed taking into account right applied practice. For example, if a taxpayer disturbed handing over of declaration on an income tax, then tax organs must take into account judicial practice, folded through this question in a concrete region.

In opinion of author, by conclusions, done in a letter, officials acknowledge that now the internal revenue code does not contain the special norms, settings responsibility of taxpayer for presentation of tax returns (calculations) in an electronic kind. From here reasonable advice to observe carefulness the inferiors at making decision - oriented on judicial instances.

Now arbitrage practice is folded so that a taxpayer can bring to the account on an item 119 NK RF only for presentation of declaration in the term set by a law. Disturbing of her presentation of responsibility does not draw. As an example we will present Decision FRONT of ВСО from 16.10.2007 № А58-2710/07-Ф02- 7689/07, a next situation is considered in which. Organization in good time presented in a tax organ declarations in an electronic kind on a diskette with confirmation on paper transmitters. In turn, налоговики said no in the reception of accounting, specifying on the duty of firm to present declarations in an electronic kind on telecommunication communication channels. Firm long did not argue and went under the thumb of inspectors, but the date of dispatch of declarations on telecommunication communication channels appeared outside the set terms. In the total organization was brought to the account on п. of a 1 item 119 NK of Russian FEDERATION. However judges decided that налоговики in this case had extended the sphere of action of norms of НК РФ about tax responsibility and, alluding to the Informative letter YOU Russian FEDERATION from 17.03.2003 № 71, specified on absence of grounds for bringing in of taxpayer to responsibility. Result of "battles" - the decision of tax organ is acknowledged by illegal. Moreover, grounds for the overvalue of conclusions of court on this dispute YOU Russian FEDERATION did not find (Decision from 14.02.2008 № 1475/08).

It should be noted that arbitrage practice, more clearly reflecting the problem of presentation of the tax accounting in an electronic kind, while not folded. How налоговики will operate in regard to taxpayers, not observing the requirement of p. 3 items 80 NK of Russian FEDERATION, to predict enough difficultly. According to elucidations of Ministry of finance all will depend on arbitrage practice on this question in every region.

In addition, in the case of presentation of declaration a taxpayer in a tax organ during 10 days upon termination of the set term inspectors can avail to the item 76 NK of Russian FEDERATION which gives a right to halt the operations of this taxpayer on his bank accounts to them. Also for violation of the terms of presentation of the tax accounting set by a tax law in a tax organ at the place of account of violator can bring to the administrative account on an item 15.5 KoAP of Russian FEDERATION. We will remind, in accordance with this norm the public servants of organization can be fined on a sum a from 300 to 500 rub.

List of literature

1. Order of presentation of tax return in an electronic kind on telecommunication communication channels.

2. Requirements about presentation of accounting in an electronic kind: Letter of ФНС of Russia from 12.03.2007 № 05-3-07/46.

3. Law "On a record-keeping"

4. Letter of Ministry of finance of Russia from 29.12.2006 № 03-02-07/1-364.

5. Order of ФНС of Russia № of ММ- 3-13/708

6. Letter of Ministry of finance of Russia from 18.01.2008 № 03-02-07/1-21, from 26.12.2007 № 03-02-07/1-509

7. Methodical recommendations

8. Regulation

9. Order the tax accounting in an electronic kind appears through the specialized operator of connection

10. By a law "On connection"

11. By a law "On an electronic digital signature"

Похожие работы

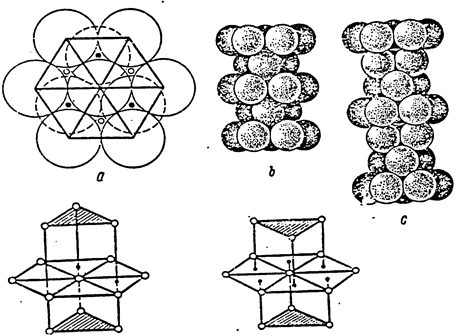

... face-centered) It follows from the speculations on the number of direct bonds ( or pseudobonds, since there is a conductivity zone between the neighbouring metal atoms) being equal to nine according to the number of external electrons of the atomic kernel for densest packings that similar to body-centered lattice (eight neighbouring atoms in the first coordination sphere). Volume-centered and ...

... , in which connection practical experience in the concrete field of activity gains great importance. Issues recommended for independent study: the Game theory, the theory of fields, the theory of crises, the chaos theory, the theory of relativity, the management, strategy and tactics theories, basics of logic and statistics – concepts, substance/essence, stereotypes, paradoxes. See also: ...

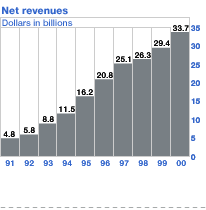

... the foundation of the first computer club. Homebrew Computer Club The legendary Homebrew Computer Club was the first of its kind, and provided an early impetus for the development of the microcomputer industry in Silicon Valley. Its first meeting in March 1975 was held in one of its members' garage in Menlo Park in Santa Clara County. The Homebrew members were engineers and computer enthusiasts ...

... the conductivity zone, which doesn’t contradict to the conclusions of Payerls. A relationship is also seen between the conductivity electrons (Z) and valency electrons (Z kernel) stipulating the crystal structure. The phase transition of the element from one lattice to another can be explained by the transfer of one of the external electrons of the atomic kernel to the metal conductivity zone or ...

0 комментариев