Навигация

Confirmation of delivery of accounting

6. Confirmation of delivery of accounting.

7. Operation ability and exactness of treatment of information. Unlike accounting, presented on a paper transmitter, data of electronic declarations and calculations set about on the personal accounts of taxpayer in the automatic mode. Probability of appearance of technical errors on the stage of input of information in this case is taken to the zero, besides in practice kameralnaya tax verification of such accounting passes in more short spaces as compared to "paper colleagues". As a result a taxpayer can count on more operative receipt of information about execution of tax obligations before a budget, including. In an electronic kind.

8. Providing of confidentiality.

It should be noted that the above-stated dignities idealize the general picture of presentation of the electronic accounting partly. Without a fly in the ointment costs however. So, to the lacks of presentation of accounting in an electronic kind it is necessary to take:

1. Presence of technical base. For preparation of the electronic accounting the presence of computer, interconnect the Internet, and also specialist (employee), trained to work with corresponding software is needed at least.

2. Dependence on work of the internet Provider and special operator. From the failures of server of the internet Provider a taxpayer can be limited in access in the Internet, as a result are problems with the dispatch of the electronic accounting in good time, bringing in of taxpayer to responsibility. An analogical situation is folded from blanks in-process the special operator. In last case, as a rule, according to an agreement responsibility is born the by an operator, however a fine will be written however on a taxpayer.

3. Failures of software. Programmatic facilities which are used for the transmission of the electronic accounting on telecommunication communication channels are distant from perfection, and from technical errors in their work for taxpayers there can be problems. So, cases are known when data of the tax accounting, given by a taxpayer, differed from information which entered tax organ. Treatment of "illness" is collation of accounting with a tax organ. Also from failures in the program the electronic accounting cannot reach to the tax organ, as a result a taxpayer will not get protocol (confirmations) from an inspection and copy of report, signed by the electronic digital signature of tax organ. Result - again to nobody not necessary trials. At the same time lately quality of work of both the most programmatic providing and tax worker in this direction became better considerably.

4. Not all errors in the tax accounting are caught by the program on the stage of control, therefore a taxpayer can unaware of their existence. However the inspector of department on work with taxpayers would specify on them to the taxpayer at the personal contact (presentation of accounting on paper transmitters).

5. Duplication of accounting with the stamp of tax organ. If a taxpayer plans to get a credit in a bank, then, more credible than all, he will have to notarize an accounting copy on a paper transmitter in a tax organ. The point is that accounting passed in an electronic kind has equal legal force with a paper variant only in case that she is notarized by an electronic-digital signature properly. However credit establishment cannot checkup this fact; therefore in most cases jars require accounting with the stamp of tax organ, but not with protocol of entrance control.

3 List of "obliged"

In accordance with p. 4 Orders presentation of tax return in an electronic kind is carried out on initiative of taxpayer and at presence of for him and tax organ of compatible hardware’s and possibilities for her reception and treatment, thus she must correspond to the format of presentation of tax returns.

At the same time p. 3 items 80 NK RF determines a list obliged to present declarations in an electronic kind. The first line in him is occupied by taxpayers, the middling list quantity of workers of which for 2006 - 2007 is exceeded by 250 persons, and from January 1 2008 are 100 persons. Thus this norm spreads on all managing subjects regardless of legal form.

Into consideration: at the decision of middling list quantity of workers taxpayers are necessary to follow rules, set by Decision of Russian mandate from 11.10.2007 № 76 for the fill-out № of 1-Т (information about a quantity and salary of workers on the types of activity) (Letter of FNS of Russia from 26.04.2007 № HD- 6-25/353@). Sending information is needed in a tax organ at the place of the account in a due form, ratified by Order of FNS of Russia from 29.03.2007 № MM- 3-25/174@.

We will remind that organizations which the isolated subdivisions enter in the complement of must determine the среднесписочную quantity of workers on the whole on organization (Letter of Ministry of finance of Russia from 29.12.2006 № 03-02-07/1-364).

Further in a list "obliged" it is necessary to designate taxpayers, subsumed the largest [4], regardless of quantity of workers. The reception of the tax accounting in an electronic kind on telecommunication communication channels from the largest taxpayers is carried out in the order, ratified by Order of FNS of Russia № of ММ- 3-13/708@ [5]. Ministry of finance considers that these payers must present accounting in a tax organ at the place of their account as the largest (Letter from 07.02.2008 № 03-05-04-01/6), thus both a head office and isolated subdivisions can do it on the basis of warrant (letters of Ministry of finance of Russia from 18.01.2008 № 03-02-07/1-21, from 26.12.2007 № 03-02-07/1-509).[6]

Moreover, in Letter of Ministry of finance of Russia it is indicated from 24.05.2007 № 03-02-07/1-256, that to this category of taxpayers from 2007 the specified tax returns must be presented in an electronic kind, but not on a paper transmitter. It should be noted that such requirements supervisory organs can spread and on other taxpayers, included in the indicated list. It is explained that item 80 NK RF does not contain exceptions for presentation of the specified declarations or calculations for past periods. Taxpayers which fall short of to these criteria are right to present in a tax organ tax returns (calculations) on the set form on a paper transmitter. Thus tax worker to say no to them not right (п. 4 items 80 NK RF). Moreover, the analogical point of view on this question is offered by Ministry of finance (letters from 27.02.2008 № 03-04-05-01/34, from 13.02.2008 № 03-02-08/5, from 14.11.2007 №03-02-07/1-472).

Похожие работы

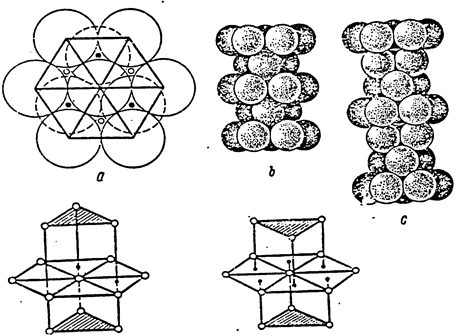

... face-centered) It follows from the speculations on the number of direct bonds ( or pseudobonds, since there is a conductivity zone between the neighbouring metal atoms) being equal to nine according to the number of external electrons of the atomic kernel for densest packings that similar to body-centered lattice (eight neighbouring atoms in the first coordination sphere). Volume-centered and ...

... , in which connection practical experience in the concrete field of activity gains great importance. Issues recommended for independent study: the Game theory, the theory of fields, the theory of crises, the chaos theory, the theory of relativity, the management, strategy and tactics theories, basics of logic and statistics – concepts, substance/essence, stereotypes, paradoxes. See also: ...

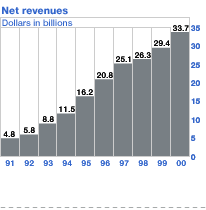

... the foundation of the first computer club. Homebrew Computer Club The legendary Homebrew Computer Club was the first of its kind, and provided an early impetus for the development of the microcomputer industry in Silicon Valley. Its first meeting in March 1975 was held in one of its members' garage in Menlo Park in Santa Clara County. The Homebrew members were engineers and computer enthusiasts ...

... the conductivity zone, which doesn’t contradict to the conclusions of Payerls. A relationship is also seen between the conductivity electrons (Z) and valency electrons (Z kernel) stipulating the crystal structure. The phase transition of the element from one lattice to another can be explained by the transfer of one of the external electrons of the atomic kernel to the metal conductivity zone or ...

0 комментариев