Навигация

16. Introduction

Here we have a form of advertising which lies between trade and consumer advertising. The most obvious examples are those for department stores and supermarkets, but it can include the advertising conducted by any supplier including a petrol station, restaurant or insurance broker.

A major form of retailing nowadays is direct response marketing or retailing without shops. This is the modern form of mail-order trading which has moved from the traditional club catalogues to sophisticated off-the-page and direct mail campaigns for products and services, of which financial houses and department stores have become leading participants.

17. Purpose

The purpose of retail advertising is threefold, as outlined below.

(a) To sell the establishment, attract customers to the premises and, in the case of a shop, increase what is known as 'store traffic', that is the number of people passing through the shop. If they can be encouraged to step inside they may possibly buy something which they would not otherwise be tempted to buy.

(b) To sell goods which are exclusive to the shop. Some distributors are appointed dealers for certain makes, e.g. the Ford dealer. Others, such as supermarkets, sell 'own label' goods, having goods packed by the manufacturer in the name of the retailer. All the goods in the shop may bear the same brand, or certain lines such as tea, coffee, biscuits or baked beans may bear the retailer's own label.

(c) To sell the stock of the shop, perhaps promoting items which are seasonal, or presenting a representative selection, or making special offers. The latter could be regular policy, or could be organised as shopping events such as winter or summer sales.

18. Media of retail advertising

The principal of media for retail advertising are:

(a) local weekly newspapers, including numerous free newspapers which gain saturation coverage of residential areas by being delivered from door to door;

(b) regional daily newspapers, of which most are 'evenings';

(c) public transport external posters and internal cards, and arena advertising at sports grounds;

(d) direct mail to regular or account customers, and door-to-door leaflet distribution;

(e) regional commercial television;

(f) independent local radio;

(g) window bills and point-of-sale displays within the shop;

(h) window and in-store displays;

(i) catalogues.

The shop itself is a considerable advertising medium, and it may well be a familiar landmark. Marks &: Spencer rarely advertise, but their shops are so big they advertise themselves. With retail chains, the corporate identity scheme will quickly identify the location of a branch.

19. Special characteristics

Retail advertising is characterised by four main aspects: creating an image of the shop, establishing its location, variety of goods offered, and competitive price offers. Nearly always, the object of the advertising is to persuade people to visit the shop, although telephone ordering and the use of credit accounts and credit cards is a growing feature.

Financial advertising

20. Introduction

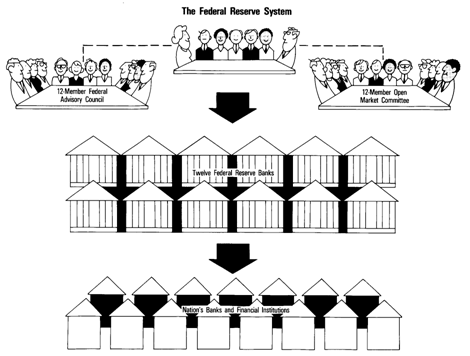

It is probably difficult to put a limit on what can be contained under this heading, but broadly speaking financial advertising includes that for banks, savings, insurance and investments. In addition to advertising addressed to customers or clients it can also include company reports, prospectuses for new share issues, records of investments in securities and other financial announcements.

Some, like building society and National Savings advertisements, may be addressed to the general public while others will appear in the financial and business press only.

21. Purpose

The object of financial advertising may be to borrow or lend money, conduct all kinds of insurance, sell shares, unit trusts, bonds and pension funds or report financial results.

22. Classes of financial advertising

The main categories in this field are as follows.

(a) Banks advertise their services which today are not confined to traditional bank accounts but include deposits, loans, insurance, house purchase, wills and executorship and advice on investment portfolios. Some banks specialise in certain areas of banking, and others concentrate on certain kinds of business.

(b) Friendly societies and private medical care organisations like BUPA offer schemes to provide insurance in time of illness.

(c) Building societies both borrow money from savers and lend money to house-buyers. Most of their advertising is directed at not only raising funds but keeping funds so that they have sufficient money to meet loan applications. Competitive interest rates are important sales points, and today in Britain there is rivalry between building societies, banks and insurance companies for the same kind of business.

(d) Insurance companies exist to insure against almost any risk from big commitments like ships and aircraft worth millions to covering [he risk that rain may stop play. Some insurance not only covers risks but provides benefits to savers or pensions in old age. In the cases of fire and theft, insurance companies are also selling peace of mind should damage or loss be suffered.

(e) Investments are offered, not only in share issues but in unit trusts and other investments in which smaller investors can share in the proceeds of a managed portfolio of shares.

(f) Savings and banking facilities are offered through post offices which sell National Savings certificates and various bonds and operate the Giro and Post Office banks.

(g) Brokers offer insurance, pension and investment schemes and advise their clients on how to manage such financial commitments. The Automobile Association acts as a broker for motor insurance.

(h) Credit and charge card companies, such as Access, and Barclaycard, American Express and Diners' Club, promote plastic money facilities, often on an international scale.

(i) Local authorities borrow money from the public, usually on short-term loans which are advertised.

(j) Companies announce their intentions and final dividends, giving summaries of annual reports, and often offering copies of annual reports and accounts.

Похожие работы

... . 8. Моя сестра не умеет кататься на коньках. 9. Она не может вас понять, потому что не говорит по-французски. 10. В прошлом году он не умел составлять финансовый отчет, а сейчас умеет. Переведите на английский язык. 1. Laws of demand and offer are fundamental economic laws. 2. Many factors are influence upon prices and salaries. 3. Prices on raw materials increased. 4. Issue goods on ...

... like that: what kinds of animals eat grass?» The boy brightened up. «Animals!» he exclaimed, «I thought you said admirals.» Unit 9 Grammar: 1. Passive Voice. 2. Пассивные конструкции характерные для английского языка. 3. Формы инфинитива. I. Language Practice 1. Practise the fluent reading and correct intonation: — Helölo, Tom! — Helølo, Nick ö. Here you ø are at ...

... лексических единиц в той или иной степени являются объектом изучения в преподавании русского языка как иностранного. ГЛАВА 2. РЕАЛИЗАЦИЯ СИСТЕМНОГО ПОДХОДА В ПРЕПОДАВАНИИ ЛЕКСИКИ В УЧЕБНИКАХ В.Г.БУДАЯ “РУССКИЙ С АЛФАВИТА” И Ю.Г. ОВСИЕНКО “РУССКИЙ ЯЗЫК ДЛЯ НАЧИНАЮЩИХ” 2.1 Общая характеристика лексических объединений, представленных в учебниках В.Г. Будая “Русский с алфавита” и Ю.Г. Овсиенко “ ...

... , о чем свидетельствуют сравнения, произведенные прежде всего в Вуппертале, как в целом, так и в отдельных случаях. О подобном же влиянии реформатской веры, обращаясь к Шотландии, говорил Бокль, а из английских поэтов — Китс. Еще более поразительна связь (о которой также достаточно упомянуть) между религиозной регламентацией жизни и интенсивным развитием деловых способностей у целого ряда сект, ...

0 комментариев