Навигация

Double Entry Types of Balance Sheet

Theme: Double Entry

Types of Balance Sheet

Prepared:

Almaty 2009y.

Plan

The Essence of Double Entry Principle

The Accounting Equation

Double Entry Bookkeeping

Ledger Accounts

Balance Sheet

Trial Balance

Interpreting Balance Sheet

Glossary

The Essence of Double Entry Principle

In accounting, the journal should has two ledger that is called double entry accounting. This method was introduce by Mediecci in 12th century at Italy. The father of accounting, Luca Paccioli is the first publisher of double entry accounting system.

Double entry accounting is a method in which each transaction is recorded in two separate accounts, i.e. in one account as a debit and in the other account as a credit. In other words, in double entry principle each transaction that has a value added to the assets account also has a value subtracted from the liabilities account - these transactions are called credits. Conversely, each transaction that has a value added to the liabilities account has a value subtracted from the assets account - these transactions are called debits.

Double entry accounting principle is used more often than the single entry principle, in which each transaction is recorded in only one account. It is used more often since it prevents many errors and promptly alerts the business to possible errors so that they can be corrected on a timely basis. Since credits and debits should always be equal, i.e. according to the essence of accounting basics there must be an equation between debits and credits, if there is ever a discrepancy between the value of the credits and debits, it is an alert to the business that an error has occurred while recording the transaction in the books of the business. Thus, with the double entry accounting principle it is quick and easy to ensure that the accounts are always balanced. Also this principle is useful to record transactions separately and present proper and accurate data to its users for the purpose of decision making relating the entity.

Example 1

Consider the following example of the double entry principle. Cut to the Chase, a hair salon, buys hair brushes in bulk once every quarter, purchase is made on credit, i.e. cash for the purchase made is paid later on after the purchase. The bulk of brushes costs $250. So, every quarter the accountant for Cut to the Chase makes $250 entry in the liabilities account (adding to the value of the liabilities) and a $250 entry in the assets account (adding to the value of the assets). Below you can see how the entries look like;

D Inventory (Assets) $250

Accounts payable (Liabilities) $250

Example 2

The next example is the usage of the acquired brushes in the activities of the Cut to the Chase hair salon. Assume that during the next quarter the company used all the acquired brushes in its activities, i.e. $250 expenses were incurred and assets decreased by $250. The accountant will record a $250 entry in the assets account as a credit and a $250 entry in the equity account as a debit, i.e. expenses as a decrease in equity. Below you can see how the entries look like;

D Expenses (Equity) $250

C Inventory (Assets) $250

As these examples show, the bottom line of double entry principle is that for each entry made in one account (i.e. liabilities or equity), an opposite entry in the same amount of the original entry must be made in the other account (i.e. assets).

The Accounting Equation

All accounting entries in the books of account for an organisation have a relationship based on the 'accounting equation':

| Assets = Liabilities + Owner's equity |

Assets

Assets are tangible and intangible items of value which the business owns. Examples of assets are:

• Cash

• Cars

• Buildings

• Machinery

• Furniture

• Debtors (money owed from customers)

• Stock/Inventory

Liabilities

Liabilities are those items which are owed by the business to bodies outside of the business. Examples of liabilities are:

• Loans to banks

• Creditors (money owed to suppliers)

• Bank overdrafts

Owner's Equity

The simplest way to understand the accounting equation is to understand what makes up “owner's equity”.

By rearranging the accounting equation you can see that Owner's Equity is made up of Assets and Liabilities.

| Owner's Equity = Total Assets less Total Liabilities |

Owner's Equity can also be expressed as:

| Owner's Equity = Capital invested by owner + Profits (Losses) to date (also known as 'Retained Earnings') |

Rearranging the equation again, therefore:

| Total Assets - Total Liabilities = Capital + Retained Earnings |

The accounting equation establishes the basis of Double Entry Bookkeeping

Double Entry Bookkeeping

All accounting transactions are made up of 2 entries in the accounts: adebit and a credit.

For example, if you purchased a book, your value of books would increase, but your value of cash would decrease by the same value, at the same time. This is double entry bookkeeping.

Ledger Accounts

A ledger account is an item in either the Profit & Loss account (which we'll discuss shortly) or the balance sheet. A Ledger account is either a:

• Asset

• Liability

• Equity

• Income

• Expense

The example of purchasing a book, mentioned above, can be shown in the form of ledger "T" accounts as follows:

“Dr” is short form “Cr” is short form for Debit for Credit

Purchases-Books

![]()

![]() Dr Cash Cr

Dr Cash Cr

$20

Cash

![]()

![]() Dr Cr

Dr Cr

Books $20

If all transactions are entered into the books in this way, then the sum of all of the debits would equal the sum of all of the credits.

Balance Sheet

Balance Sheet is one of the three main Financial Statements. It reflects structure of the company's assets and financing sources used to finance these assets as of particular date (i.e. as of year end).

Referring to the Accounting Equation, where:

Assets | = | Liabilities | + | Equity |

Balance Sheet reflects the same principle, i.e. one side of the Balance Sheet represents Assets and the other side - Liabilities and Equity. The must be a balance between the total value of the Assets and the total value of Liabilities and Equity.

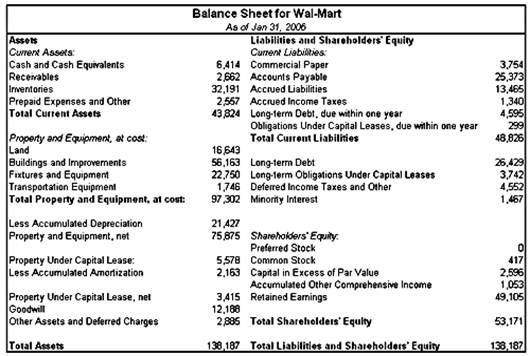

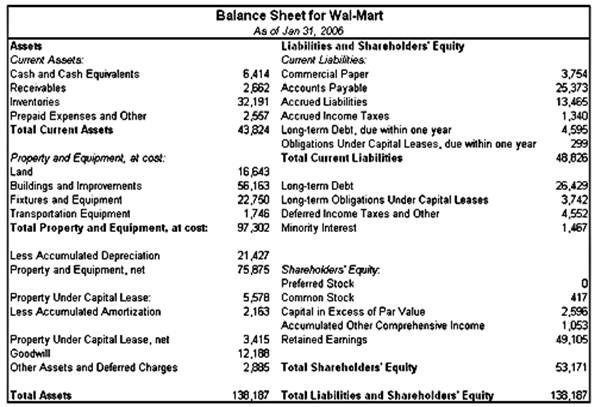

Assets are properties (can be material, immaterial, monetary) owned by the entity, i.e. any physical thing (tangible) or right (intangible) that has a monetary value. Assets usually are divided into Current Assets (cash and other assets that may reasonably be expected to realized in cash or sold or used within period less or equal to one year. Examples: inventory, cash, accounts receivable, prepaid expenses) and Long-term Assets (used by the entity for a period longer that one year. Examples: long-term investments, fixed assets, intangible long-term assets).

Liabilities are debts owned to outsiders, i.e. creditors. Divided into Current Liabilities, which are due within one year (accounts payable, salaries payable, taxes payable, interest payable) and Long-term Liabilities which are due after one year

Equity includes amounts invested in a business by owners, special kind of liability residual claim against assets of business after total liabilities are deducted. Includes Share Capital (financial means invested by the shareholders), Retained Earnings – net income retained in the business.

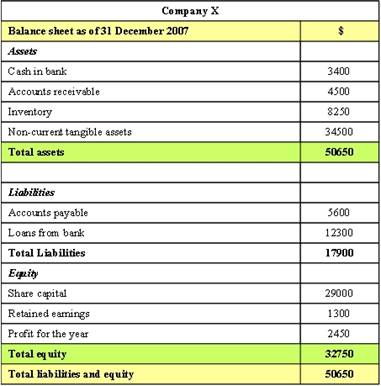

Below there is an example of the Balance Sheet:

You can see that total value of the Assets ($50650) equals to the total value of Liabilities ($17900) and Equity ($32750).

Trial Balance

A trial balance is a list of all of the ledger accounts of a business and the balance of each. Debits are shown as positive numbers and credits as negative numbers. The trial balance should therefore always equal zero.

If the journal entries are error-free and were posted properly to the general ledger, the total of all of the debit balances should equal the total of all of the credit balances. If the debits do not equal the credits, then an error has occurred somewhere in the process. The total of the accounts on the debit and credit side is referred to as the trial balance.

The more often that the trial balance is calculated during the accounting cycle, the easier it is to isolate any errors; more frequent trial balance calculations narrow the time frame in which an error might have occurred, resulting in fewer transactions through which to search.

Interpreting Balance Sheet

Похожие работы

... ефективності компанії. Є цілий ряд окремих фінансових коефіцієнтів, що інвестори використовують, для того, щоб дізнатися більше про компанію. Vocabulary Balance sheet баланс Financial position фінансовий стан Assets активи Liabilities пасиви Ownership equity власний капітал Equation рівняння Personal ...

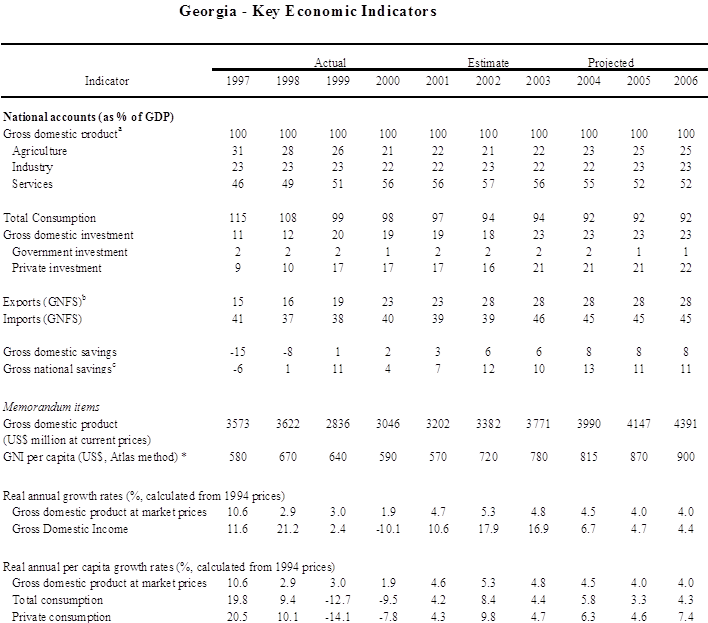

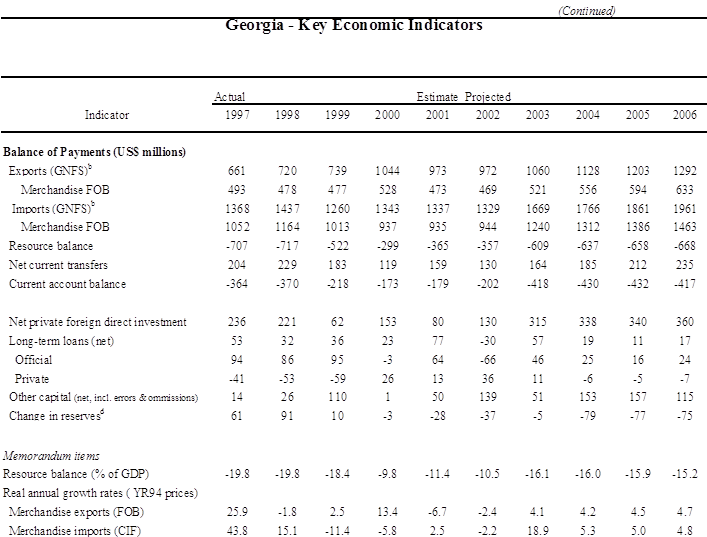

... OF GEORGIA JSC – Valuation (Refer to Annex 1) Valuation Limits True Value (GEL mln.) True Value/Market Cap. Low 50.8 3.3 High 68.6 4.4 4.3 Human-Resource Development in the Private Sector 4.3.1 Business Schools/Universities European School of Management (ESM). Data Sheet. European School of Management ESM-Tbilisi 40, Vazha ...

... daily. As a general rule, when you're buying and selling inventory, accrual-basis accounting works better than cash-basis accounting. QUESTIONS 1. What is the expression of accounting as ‘the language of business’? 2. How can the government control tax discipline? 3. What is the essence of accounting? 4. What main operations does the basic accounting cycle include? 5. Why do ...

... to meeting you, I remain Sincerely yours Gennady Bogachev Deputy DirectorTask III. Conversation on the topic of your thesis аспирантура (канд. экз.) Экзаменационный билет (на 2 листах) по дисциплине английский язык (специальность: социальная философия) билет №2 Task I. Translate from English into Russian in writing using a dictionary. Your time is 45 minutes The book opens with a broad ...

0 комментариев