RUSSIAN FEDERATION COUNTRY STUDY

A PUBLIC FINANCE PERSPECTIVE

Ryan Grace rgrace@indiana.edu

Dmitri Maslitchenko dmitri@mailroom.com

David Lamp dlamp@indinana.edu

![]()

Political Background

The separation of powers which existed under the Soviet constitution was essentially a myth. A Russian accurately characterized the relationships that existed between party, state and society as, ...The state absorbed the society, the Party absorbed the state, and the Party appartchiks, the nomenclature under the totalitarian leadership of the Secretary-General absorbed the Party." Both legislative and judicial branches served as rubber stamps" to the Presidium of the Supreme Soviet which unlike the Supreme Soviet itself was constantly in session. The development of political reform in the late 1980s weakened the party's control over the reigns of power. The devolution of power from the Presidium occurred through the creation of the office of the President which received the executive powers while the legislative powers were assigned to Congress of Peoples Deputies. The judicial branch also achieved higher visibility during the late Soviet period through the creation of the Committee on Constitutional Supervision. The Soviet Union's collapse in 1992 introduced radical changes into all aspects of Russian society. Russia has little experience with democracy in any form. Without a strong democratic tradition, it should not be unexpected that instability would develop in all aspects of Russian life. The role of governmental finance in post-Soviet society is no exception. Competing explanations exist for Russia's travails but a shared trait of many them is the distribution of power at the federal level and the relationship between the federal and sub-national levels of government.

Political problems did not take long to develop in the Russian Federation after the USSR's dissolution. At the federal level, the creation of the present constitution is one cause of the instability which plagues Russia today. After winning a national referendum on August 15, 1993 in which the electorate was asked to endorse the Yeltsin's reform policy, he convened a constitutional assembly to ratify his version of the new constitution. Three drafts were in contention to replace the constitution under which the Soviet Union was nominally ruled. Other than Yeltsin's constitution which became the one implemented, the two other variants were the communist draft which advocated a strong Presidium of the Supreme Soviet with a chairman who had similar powers to the position of General Secretary during the Soviet period and the Rumyanstev draft which contained plans to restrict executive power and grant the legislative body wide powers. Yeltsin's draft advocated the exact opposite of the aforementioned plans with wide powers to the executive and minimal power delegated to the legislative. After the Duma rejected Yeltsin's order to dissolve, he ordered military troops to forcefully evacuate the building--which they did by shelling it. Briefly, the president is the protector of the constitution, human rights, and civil liberty. In order to protect the constitution and the aforementioned rights, the constitution grants the president wide injunctive and declarative powers. The former powers consist of the president's ability to use "conciliation procedures to resolve disputes between the federal government and the governments of the constituent subjects and disputes between the various subjects of the federation." A three stage procedure exists for the adjudication of disputes but his ability to suspend legislation after it is submitted to the appropriate court" which he deems to be in violation of the constitution is considered by many as inappropriate for a fledgling democracy. The President also has the power to issue decrees and orders which are superior to the laws of the government as long as the decree or order does not violate the constitution. Further, the president has the ability to appoint important member of his government without consent for the Duma and has sole power to appoint and remove the command structure of the Armed Forces. In regards to the legislature, the president has the ability to dissolve the Duma if it passes two no-confidence vote in the Russian government within three months of each other and if it rejects three presidential nominee for Chairman of the Russian government. Although there are limitations of the president's ability to dissolve the Duma, it remains a potential weapon against a contentious parliament that affects every aspect of public finance.

The power of the legislative and judicial branch are limited in relation to the executive. Russia's judicial system consists of a several court systems that have different spheres of federal/national jurisdiction." The most visible court is the Constitutional Court which has the right to review the constitutionally of all federal laws, presidential orders and degrees, legislation of government, and unratified treaties. Challenges to the aforementioned areas must be brought by individuals with standing. Although the Constitutional Court's power seems vast, the president's expansive powers and lack of civil relations between the different branches makes the Court's utilization of this power suspect. Federal law and federal constitution laws are the two types of laws which exist in the Russian Federation. The latter is considered superior to federal laws. The procedure for enactment differ in each case. Once a bill is passed it must presented to the president within five days of the passage by the parliament. The president then has fourteen days to reject the law. In order to veto the federal law, a two-thirds majority must be gained in both parts of the legislative assembly. In the case of federal constitutional law, three quarters of the Federation Council and two thirds of the Duma must approve it for enactment. The constitution does not describe any right for the president to veto federal constitutional laws. According to Article 106 of the Russian Constitution, laws in regard to the following area must be voted upon by the Federation Council: The federal budget, federal taxes and levies, foreign currencies, custom regulation, and currency issuance.

BudgetingRecently, the Duma rejected the government's first draft of the budget. Deputies were divided over the size of the projected federal budget deficit, which was set at 95.4 trillion rubles or 3.5 percent of GNP. When the budget is rejected by the Duma, the government has 20 days to revise and re-submit the budget. If differences exist between the government's proposed budget and the Duma's, an option exists to create a committee to reconcile their disagreements. The Duma rejected the government's proposed 1997 budget in October 1996 and did not opt initially for such a commission. If no budget agreement is reached, parliament would be forced to pass monthly or quarterly budgets which would cause confusion throughout the economy. Since the initial rejection however, a reconciliation commission (in which both houses of parliament and the government are represented), has been working on a new version. The reconciliation commission is due to have a final meeting on Wednesday, with the Duma giving the budget a new first reading on November 20 or 21. There is no legal framework to cover the failure to pass the budget, but parliament has faced the problem every year of Russia's independence except 1996 and has in the past approved temporary budgets.

The work of the reconciliation commission is being drawn out because neither the communist majority in parliament nor the government wants to take responsibility for making a decision on the budget. Russia is trying to keep to a small deficit in 1997 under pressure from the International Monetary Fund, but the Duma is eager to increase budget spending to a starved economy. Reform minded deputies want a lower budget deficit to achieve lower credit rates--which they say are vital for economic growth but which are kept high through heavy government borrowing. The dilemma is that the communists in the parliament want to increase spending and as a majority they can block implementation of any budget bill.

TaxationRussia's tax system is an exercise in frustration for both Russians and foreigners. The problem arises because it seems that many taxes spring out of the blue and carry heavy retroactive penalties" which are often three times the tax amount due. Russian tax reform is difficult now because the government desperately needs money and has little room to maneuver since revenues are static and low. The budget take, both federal and regional, came in at just 27.3 percent of GDP, compared to 50 percent in the Czech Republic and 47.7% in Poland Russia's budget deficit has been narrowed in recent years, but this only been achieved by cutting back on expenditures in real terms, almost 50 percent from 1993 to 1995.

Like the United States, Russia has a three-tiered system of taxation. Federal taxes are enforced by Parliament, regional taxes enforced by the regional councils, and local taxes enforced by the local authorities. Under the existing system, very little coordination can be found between the three levels of government which causes serious tax policy problems. In a 1993 decree, regional and local authorities were given the power to decide on types and sizes of taxes for their jurisdictions. The hope was that authorities at each level, being responsible to its citizens, would act within reasonable limits. Local authorities, seeing a way to increase revenue, devised more complicated and exotic taxes. There are 150 locally imposed taxes within the Federation . They were competing who would invent the more interesting taxes at their respective levels--for example a tax on grazing cattle.

Tax Code

The Russian tax system is very complicated. The first two sections of the new code have 416 articles which are contained in more that 100 pages--and this is just an the overview of general principles. In an effort to improve tax law, a new draft of tax code was presented to the Russian parliament in February 1996. Apart from laws, the tax regime is regulated by many other documents. The list of these tax documents includes 900 items. It is understandable that the taxpayer can be confused by so many documents. Even a good taxpayer can make mistakes. The code is not expected to be enacted this year but it is a good step toward improving the clarity of the tax system. The current system, plagued by an excessive tax burden and rampant tax evasion, has seriously impeded tax collection efforts. The proposed draft code seeks to implement a number of the reforms prevalent in Western economies during the 1980s, including a broadening of the tax base, lowering of tax rates, and the reduction of incentives, exemptions, and deductions.

A new mechanism for tax refunds in the case of overpayment is also provided in the code. If a taxpayer paid too much tax at his own initiative, the taxpayer may request the overpayment amount be credited towards his next payment or be refunded within a specified time limit. If the time limit was exceeded, the amount would be refunded with interest at a interest rate tied to the prime rate of the Central Bank. In January 1996, new rules came into effect concerning the refund of VAT if the taxpayer is involved in exports operations. It was a major problem since VAT refunds were the responsibility of local budgets. The 1996 budget, which was submitted in mid-August, provided such VAT refunds from special funds of the federal budget.

Overview of Major TaxesIncome tax

Russia's individuals income tax has several bands which range from 30 to 60 percent. The 60 percent rate is essentially the only rate in effect for Westerners. In 1993, the tax law was changed. Earlier, individuals could only pay taxes in rubles. Now, taxes on income earned in hard currency may be paid in rubles or in hard currency. Proposals to increase the Russian personal income tax rates were rejected by Russia's upper house, so the 1995 personal income tax rates remain in effect as of January 1, 1996 (see appendix). Three tax brackets now exist in the Russian Federation: 12 percent on income up to Rubles. 10 million, 20 percent up to Rubles. 50 million, and 30 percent over Rubles. 50 million. The current exchange rate is one dollar to approximately 4,700 rubles. While many individuals may complain that the higher income tax rates will cripple them, Russia would still have the lowest personal income tax rate in Europe at 35 percent.

Excise taxThe excise tax in Russia explicitly covers imported luxury goods, including tobacco products, beer wine and spirits, cars and light truck, tires, jewelry, gemstones, rugs, crystal, fur, and leather products. The rate of excise tax ranges from 10 percent for crystal to 90 percent for grain alcohol personal. A new principle was applied, in accordance with a recent decree, to the calculations of excise taxes on alcohol and tobacco imports. In contrast to the previous practice where excise taxes were calculated in proportion to the customs value of the imported goods, under the new procedure, the taxes (on August 1, 1996) will be imposed in ECU per one unit of commodity item. In some ways, excise taxes and single-stage retail taxes would seem to be prime candidates for regional taxation in the Russia just as they are in market economies, especially if the taxing locality is large enough to avoid revenue loss from consumers crossing the border to regions with lower tax rates Such taxes thus seem more suitable for larger intermediate governments than for small local governments.

Profit taxThe profit tax calls for a 32 percent tax on all profits, with an exception for profits generated by retailers. Profits by retailers are taxed at a 45 percent rate. The tax discriminates against Russian workers because the tax is not applied to the wages of foreign workers. The profit tax keeps intact the profit reinvestment concept of prior Soviet tax legislation. Essentially, no tax is imposed on profits reinvested in the business venture. Also, the government has not changed the 15 percent withholding rate for interest, dividends, and other passive income. A 20 percent withholding rate applies to royalties on copyrights and licenses.

VATA VAT of 28 percent passed into a law on December 6, 1991 and became effective on January 1, 1992. The VAT was not initially imposed on imports or exports. However, the government changed the policy very soon afterwards. For instance Russian neighbor, Ukraine will be happy to realize that Russia imposed a VAT on imported goods originating from Ukraine (Decree No 1216 of August 18, 1996). The reason for the decree is to preserve stability of the Russian commodity market. The decree also takes into account that Ukraine is not a part to an agreement signed by the member states of the Commonwealth of Independent states on the coordination of tax policy. The general VAT rate as of January 12, 1996, remains at 20 percent. A rate of 10 percent applies to certain food items and children's goods. Payment of the profits tax and VAT of state owned enterprises is centralized at the level of their ministries administrative departments (Decision No 629 of May 22, 1996).

Corporate income taxThe corporate income tax has three tax rates and the application is based on the type of income earned. Manufacturing income is taxed at 18 percent, service income at 25 percent, and income earned by retailers at 45 percent. One of the most interesting things is that the revenue is not intended to go to the central government. Moreover, the law is written that regional authorities can tax corporate profits up to 18 percent, 25 percent, and 45 percent.

Sales taxThe sales tax was first introduced on December 29, 1990 by USSR Cabinet of Ministers. It was decided to approve a list of goods and services whose sale on USSR territory will not incur the 5 percent sales tax. The local and regional authorities may make additions to list of goods in everyday demand and services to the population which are exempt from the sales tax (see the appendix). population.

Further Drawbacks of the Russian Tax SystemAttorneys and tax specialists in Russia say the greatest problem facing enterprises is the lack of a satisfactory tax code. It is necessary that tax policy should be circumscribed and that more power should be given to the legislature. The nature of the tax structure allows some people to be heroes by breaking the rules. For example, a pharmaceutical company chief who had his security guard expel tax inspectors from his head quarters and vowed to shoot them if they returned, was elected to a seat in Parliament instead of going to jail. The penalties for non-payment of taxes is a defiency of the tax system that drives people from the tax system because they are so afraid of making a mistake that they prefer not to pay. For example, a standard 100 percent fine exists for understating income. The interest rate on late payments alone amounts to 0.7 percent a day, or 255 percent per annum, a penalty that can dwarf the actual liability. The penalty amount is presently reduced and is tied to the refinancing rate of the Bank of Russia. The penalty for each day of delinquent payments would equal 1/300 of the prime rate of the Central Russian Bank.

Russia also does not have a specialized tax court. To seek justice in tax issues, taxpayers have to find a people's court which is willing to accept the case. The courts do not have expertise in the area of tax law which is why most of the courts are reluctant to accept tax cases. The lack of legal recourse leads to corruption within the tax collection system. Russia does not have a law like the Freedom of Information Act (FOIA) or the Privacy Act which hinders the accountability of the tax service.

Aside from ample monetary reasons to evade and avoid taxes, taxes (in the Western sense) did not exist in Russia during the Soviet period and therefore the idea of a Western style taxation is unpalatable to many Russians. Taxes began to appear in the USSR only in 1991 which means that the current population has only had to deal with the issue of taxation over a short period of time. The result of this historical experience is that only between 60 and 75 percent of projected tax revenues have been collected this year.

Recent attempts to Improve RevenueDecree No 1212 of August 18, 1996 is designed to improve tax collection by preventing tax evasion and streamlining cash and non cash turnover. Among other measures, the decree orders enterprises in arrears of payments to the government to open settlement accounts in banks or credit institution within the Russian Federation. Those accounts are referred to as accounts of enterprise in arrears. When requested by the appropriate tax authorities, banks and other credit organizations are required to provide data about the transaction of enterprises holding these accounts. Taxation organ may refuse to register the account of an enterprise in arrears in case there are no funds available on the correspondent account of the bank or other credit organizations. An interesting aspect of this decree is that the government finally began to crack down on misrepresentation "in case of noncompliance with this requirement or intentional provision of false information in the notice submitted to taxation organ enterprise in arrears that had performed the transactions in question will be fined by the taxation organ in the amount of the transaction value". It has proposed to improve the tax system by scrutinizing financial transactions through banks. If an enterprise opens a bank account, the bank or other type of credit institution must immediately inform the tax organs about the accounts for tax purposes. Such tax policy will let the tax agencies observe tax payments more efficiently as everything will be recorded.

Presidential Decree No 1212 of August 18, 1996 also introduced policies concerning cases containing the circumstances stipulated in the Law of the Russian Federation on Insolvency (Bankruptcy) of Enterprises, the Federal Department on Insolvency (Bankruptcy) at the State Property Management Committee of the Russia Federation shall file with arbitration court request to institute proceedings on insolvency (bankruptcy) against enterprises that have repeatedly violated this Decree during one calendar year. As it was with collective farms and state farms, enterprises can just change their names and continue to evade taxes. An important issue related to insolvency is loss of massive amounts of jobs and what will workers and one enterprise" towns do for a living and revenue.

On the bases of the decree, the government has widened its crackdown on tax evaders--adding several leading oil companies to a list of tax delinquents that might be forced into bankruptcy court unless they pay their arrears. The move was the latest in a series of desperate measures the government is taking to boost tax collection and mend its thread bare budget. The government hopes that by threatening major tax evaders with bankruptcy, they will scare the country's errant tax payers into filling empty coffers. Major companies targeted for bankruptcy can avoid insolvency proceedings, if their accounts showed the government owes them an amounts equal to their tax debts for fuel supplied to state organizations.

The most recent step in fighting tax evaders was Russian presidential decree No 1428, (dated (October 11, 1996, which created a Processional Emergency Commission (the Commission) on strengthening fiscal discipline. The major principals and objectives are:

. Control over the timely and full payment of taxes and customs and other compulsory payments; . The elaboration of measures to secure a full-scale collection of taxes and other compulsory payments; . Securing the legality and efficiency of the work of tax and customs, as well as tax police agencies; . Control over the timely and special-purpose use of the resources of the federal budget and state extra budgetary funds. . Take decisions to carry out checks of the financial and economic activity of legal entities and compliance by individuals and entities with the tax, customs and banking legislation of the Russian Federation; . Check the operations of tax and customs bodies;

. Organize check of the timely and special-purpose use of the resources of the federal budget and state extra budgetary funds.

In addition, the President granted broad powers to the Commission to meet the objectives of the decree and secure its accountability.

Monetary PolicyInterest rates, much to the chagrin of reformers, in the past barely reacted to currency stabilization and the ensuing drop in inflation. Little confidence existed in the sustainability of reforms while inflation expectations remained high. In 1996, interest rates finally started to come down--albeit slowly. Real interest rates, however, are still very high. As recently agreed by the Russian government and the IMF, the ruble is due to become convertible by 1997. Better access to the ruble market could thus lead to a rapid increase in international interest in the currency. Nevertheless, the ruble is trying to join the club of respectable currencies. Due to the establishment of a crawling peg, the currency's downslide is almost under control. A generally more stable economic environment and high interest rates could make the ruble more attractive. The ruble's recent past has been eventful to say the least. Between January 1992--effectively the start of economic reform under Yeltsin--and March 1995,the currency depreciated by a massive 2,130 percent. In the second quarter of 1995, an over-restrictive monetary policy led to a severe shortage of the currency which then duly appreciated by 15 percent within three months. As concerns rose that too rapid currency appreciation would further destabilize the economy, the free-floating ruble program was abandoned and a 'ruble corridor', which envisaged further depreciation but within predetermined limits, was introduced. The ruble corridor program has proven to be quite successful. The Central Bank, which has been intervening repeatedly in the market, has managed to keep its foreign exchange reserves at a satisfactory level, and the business community has been able to rely on a more predictable exchange rate trend. In July 1996, the 'fixed' ruble corridor (the upper and lower limits of which only had to be redefined every few months) was transformed into a 'variable' ruble corridor, with the band shifting on a daily basis. Under this program, monthly depreciation now stands at around 1.5 percent. By the end of December 1996, the exchange rate against the dollar should have reached Rb 5,700/US $.

Russia's monetary environment started showing promising signs of stabilizing in 1996. During 1995, inflation reached 200 percent by December. 1996 is drawing to a close and the inflation rate seems set to fall to 19 percent. The central bank has been pursuing a very consistent policy lately, so its goal of maintaining monetary stability looks credible. Moreover, low inflation is one of the conditions imposed by the IMF in return for its monthly credit and it is therefore hardly in the government's interest to start emission based means of financing the budget deficit. The main risk for inflation could come from a high budget deficit due to low tax revenues. Financing the deficit has become easier than in the past due to good international credit ratings--for example, IBCA: BB+, Moody's: Ba2.--are making it cheaper for Russia to borrow on the foreign capital markets.

A key element of Russia's macroeconomic stabilization program has been a tight monetary policy to soak up excess rubles floating around the Russian economy and fueling inflation. That policy's success is among the factors that drove T-bill yields up by 26.6 percent Monday to an annualized 121.4 percent on the secondary market. Just a month ago, yields stood at 53.33 percent, according to Skate-to Press Consulting Agency.

The reason for the jump, analysts say, is simple supply and demand - little ruble supply in the market at a time when government spending demands revenue. The banks do not have the money to invest in GKO (treasury bills) at 3 percent per month--but they will find the money to invest for 10 percent per month. Russia's monetary expansion under the IMF agreement is not to exceed 3 percent, compared with 9 percent in December. Combined with promises by Yeltsin to repay wage arrears and ease the impact of reforms on the social sphere, that tight policy has forced the government to raise yields as a lure to banks to loan the government money.

Intergovernmental FinanceThe decentralization of the Russian Federation's intergovernmental financial relationships began with a series of successive tax sharing arrangements along with the regions expenditure responsibilities increasing. This sharing and reassignment strategy continued up to and on through the adoption of a new constitution in December 1993. In Russia, the tax formula sharing rates vary by region and are often negotiated by each locality with the center. This makes any assessment about the equity impact of transfers or their effects on local revenue effort difficult. A general disadvantage of tax sharing is that it does little to enhance local accountability or efficiency. Localities receive revenue regardless of their tax effort and have no discretion to set the tax rate or base. If they view these revenues as costless, their incentive to spend efficiently is lessened. The result may be undue expansion of subnational spending. In Russia shared taxes are retained by (or accrue to) the jurisdiction in which they are collected. This differs from most market industrial and developing economies where shared taxes (like the VAT in Germany) may be shared through a formula based on factors such as population, per capita income, urbanization or other factors. Derivation-based sharing as a rule channels resources to high income areas where the tax base and, therefore, revenue collections are largest. It is thus inherently counter-equalizing. This may be a problem in countries where regional inequities are serious and where the intergovernmental system lacks other instruments (such as transfers) to address such imbalances.

The intergovernmental fiscal relations of the Russian Federation continues to be highly opaque due to the bargain-based system which presently is being utilized. The bargain-based system is making accountability in fiscal policy even worse than is necessary--therefore further reducing the transparency. The size and structure of the Russian Federation contributes to the problems occurring in its fiscal relationships. It is made up of 89 regions consisting of 29 republics, 50 oblasts, 6 krais, and 10 autonomous okrugs, plus 2 metropolitan cities (Moscow and St. Petersburg) which are referred to as the 89 "subjects of the federation" in the constitution. The regions are even further subdivided into more than 2000 districts, where all the local governments within a region report to the regional governments and are subject to regional regulations, although each local government has independent" (emphasis added) budgetary and administrative status.

Effects of DecentralizationEconomic decentralization has led to the transfer of a number of services with major benefit spillovers (education, health, and social welfare) to the regional and local levels. While the administration of these programs by local governments may be appropriate because they are closer to the people, the many small local governments that have been created as a result of the strong political push for decentralization cannot likely provide these services at an adequate level from their own resources. In some regions, enterprises' "public" spending exceeds budgetary social spending and, in a few "one-company towns" there is no public spending by the budget at all on non-administrative functions. Enterprises did not provide these services once privatized, and responsibility fell onto regional and local governments to finance them. But local governments will need revenue sources to finance the additional burden.

Decentralization, which led to ownership assignment and financial responsibility, has caused the regions to become more involved in the commercial sector through producer subsidies, capital transfers, and privatization. It has also led to the budgetary expenditures by the regional governments to increase from 13 percent of the GDP in 1992 to around 18 percent in 1994. Recent policy changes have suggested that this trend of more subnational spending is likely to continue.

The Federal government has approved legislation which led to the previously discussed changes in expenditure assignment and also gave local governments the power to formulate budgets and raise revenues without worrying that their surpluses were going to be extracted by the central government. These new assignments of expenditures are not efficient, in part because the federal government has passed down" many of the expenditure assignments which were formerly the responsibility of the Soviet state. Revenue autonomy has not been reached partially due to the yearly changes in tax sharing rates. Disparities between the rich and poor regions has also contributed to a problem budgetary concern. Along with these disparities, the high rate of inflation has significantly contributed to revenue unpredictability of the rayons and oblasts. Revenue predictability and the subnational area's economic state due is of the utmost importance when one is considering expenditure assignment of the federation.

Social Welfare and RussiaThe significance and necessity of an efficient social safety net in the Russian Federation can only be understood within the context of the Soviet experience of social security and how today the ideological inclination toward a welfare state is affecting Russian society. The state's pervasive role in Soviet society affected both economic and social conditions. Economically, a state-caused inverse relationship existed between GDP and the state's commitment to social safety during the Brezhnev regime. Economic and political stagnation characterized the latter years of the Brezhnev era. Economically, GNP growth declined precipitously between 1961 and 1985 (see A1 and A2). Prior to 1960, the USSR utilized extensive rather than intensive factors of production--specifically labor, capital (stock), and natural resources. In essence, Soviet authorities were able to take advantage of Imperial Russia's lack of a strong industrial base by transferring much of the population from agriculture to industrial production during Stalin rapid industrialization drive of the 1930s and 1940s. The emphasis placed on heavy industry produced a correspondingly high rate of consumer saving which allowed for increased capital growth, that when combined with the natural resource abundance and intensive use of existing capital helped sustain economic growth The USSR's ability to sustain economic growth in the 1970s was fostered by its large reserve of oil that helped finance imports of western technology.

The exhaustion of labor surplus, declining birth rates, inefficient use of natural resources and other factors of production, the growing expenditures needed to maintain military parity with the United States, and the sudden drop in oil prices, and the mis-development of the economy all were factors that contributed to the USSR's economic stagnation in the late 1970s and early 1980s. While economic efficiency decreased during the Brezhnev period, the USSR's leadership demonstrated increased commitment to the Soviet version of the social safety net. The party-state's pervasive role in society had the effect of slowing economic growth through poor re-allocation of resources and the social effect of retarding the development of a civic society. As a result, Soviet society developed an enduring attachment to the idea of an omnipotent state which provided for their basic needs regardless of the economic costs.

From a Western perspective, the Soviet Union was ideologically a hyper" welfare state in the sense that prior to the Gorbachev era, the state attempted to provide a high level of social security for every citizen, often to the point of harming economic efficiency. Additionally, it heavily restricted the development of private sector in order to prevent wide wage disparity. As mentioned above, the CPSU's monopoly on power extended to every aspect of society and in exchange for party dominance the working population received implicit social guarantees in the form of a social contract." Linda J. Cook succinctly identifies each sides' basic commitments and responsibilities:

Basically, the regime provided broad guarantees of full and secure employment, state controlled and heavily subsidized prices for essential goods, fully socialized human services, and egalitarian wage policies. In exchange for such comprehensive state provision of economic and social security, Soviet workers consented to the party's extensive and monopolistic power, accepted state domination of the economy, and compiled with authoritarian political norms. Maintenance of labor peace in this political system thus required relatively little use of overt coercion.

The weakening of the party and other unintended consequences of glasnost and perestroika such as the emergence of the Russian Republic, the decision to release Eastern Europe from Soviet domination, and the attempt to make state owned enterprises more efficient all had a direct impact on lowering the standard living for the USSR's population. Gorbachev tried and failed to cut the guarantees of the social contract. In contrast to earlier in the Soviet period, the perestroika reforms had the effect of giving significance to money" in the sense that inputs had developed value through the economic decisions which constituted perestroika. From the center's perspective, the problems caused by the inability to cut expenditures through revision of the social guarantees were compounded by revenue loss in three key areas: vodka sales, turnover tax, and republic contribution to the center--especially from the Russian Republic.

Gorbachev began perestroika with an attack on worker efficiency. One measure adopted to combat this perceived evil was restriction on the sale of alcohol. The consequence was a loss in revenue which was further compounded by expenditures related to the Chernoybl disaster and the massive Armernian earthquake in 1987. In 1990, the center granted state owned enterprise (SOEs) greater leeway in the setting of prices--between 50 percent and 100 percent of state mandated prices. Since retail prices were unaltered, the state lost a huge amount of revenue from the turnover tax. In addition, Russia offered to lower the profit tax for those enterprises willing to pledge" allegiance to the Russian Republic. Finally, the dissolution of the Soviet Union was hastened by the rise of Russian nationalism and populism both of which had economic implications. The Russian Republic provided 80 percent of the revenue to the USSR's budget. Yeltsin, using his powerful position within the Russian parliament, declared in October of 1989 that the Republic would halt all payment to Union institutions. He followed this devastating maneuver by nationalizing" the USSR Ministry of Finance and seizing its mints. In October of that year, Russia seized her share of the USSR'S precious metals. Faced with such tremendous loss of revenue which created a budget deficit that equaled 10 percent of GNP, the Soviet government elected to increase the amount of money in circulation without a corresponding increase in the production of consumer goods and services. The decision to increase money circulation, through wage increases, had a jarring effect on Soviet society. The first impact, characterized by the indelible image of long bread lines and the stereotype that a large profit could be made on a pair of Levis familiar to many Westerner was the result of the disruption of goods and services to the general population.

Price stability began to go by the wayside in the fall of 1988 with an estimated inflation rate of 7 percent which mushroomed to 10 percent in 1990. As Table A3 and A4 indicate, the state increased both the level of wages and subsidies in the other which constituted the component parts of the Soviet safety net. Real wages, however did not compensate for inflation. The decline in social welfare from a monetary angle was compounded by quality decline in social consumption areas. Although the state increase subsides to social consumption areas, the collapse of the Council on Mutual Economic Assistance (CMEA) which provided much of the USSR's medicine and medical supplies and a growing environmental movement which forced the closure of many chemical plant that supplied the limited domestic market. Gorbachev's attempts at reforms destroyed not only the social contract which existed between the state and its citizens but the USSR as well. The late Soviet period thus provides the starting point for examining poverty and the Russian Federations response to it in the form of the social safety net.

The Soviet social welfare system was effective in that absolute poverty, i. e. wide spread hunger or inadequate diet, was avoided in the latter years of the Soviet period since the state could supply the basic needs of the population through its control of USSR's resources and society as a whole. Research into question of poverty and therefore poverty alleviation policy (specifically the question of income inequality and distribution) was hindered by the imposition of political rather than economic explanations. In 1965, the Soviet Labor Research Institute adopted a social minimum income norm which was derived from the estimated costs of human consumption. Goskomstat revised the income level based on the prices reported by state-owned stores. The price consumers were faced with, however, due to their shopping habits, the existence of a black market," and inflationary pressures dramatically reduced their purchasing power. The Russian Federation revised the poverty line in 1992 to encompass the age and gender of individual households. The six categories are: children under six years of age children between the ages of 6 and 17, men between the ages of 18 and 59, women between the ages of 18 and 54, men age 60 and above, and women age 55 and older

Closer to the U.S poverty line definition, the Russian poverty level is established by first collecting low-cost cost food baskets for each demographic group... [and] after pricing each market food basket at national prices, age, and gender-specific multipliers yield individual poverty line for each demographic group. The definition of poverty is critically important to social welfare of Russia because, in theory, it sets pension, minimum wage level, and welfare payments. The USSR's dissolution has altered the scope, source and method of financing of social welfare programs. The Soviet state provided a broad range of social services, through state owned enterprise. From a public finance perspective, the transition to a more market oriented system has meant the diversification of social spending responsibility through the creation of off-budgetary funds (OBF) and passing down the bulk of public social spending mandates to sub-national governments. The following are the major OBFs: Pension Fund, Social Insurance Fund, Employment Fund, and the Fund for Social Support.

Created in 1991, the Pension Fund was designed to take pressure of federal budget and is authorized to collect a mandatory payment from employers in the form of a mandatory 28 percent contribution while from agricultural enterprises the mandatory contribution is 20. 6 percent and 5 percent of the total income of self-employed individuals. Employees make a 1 percent contribution to the Fund. Labor pensions, financed from these contribution, and social pension which are financed from the federal budget are administered by an independent government agency. The former constitute the majority (80 percent) of Russian pensioners and thus the level of labor pensions affect the lives 19. 5 percent of the Russian population. To be eligible for labor pensions, men must have made 25 years worth of contributions while women must have made 20 years of contribution. Eligibility for labor pensions can be lower depending on occupation--hazardous occupations such as coal mining and military service are two examples. Social pensions are for individual with less than 5 years of work experience and is equal two-thirds of the minimum old-age pension or in the case of disability the amount varies but does not exceed the minimum labor pension.

Payroll contributions are the also the main source of funding for the Social Insurance Fund (SIF) and the Employment Fund. Created in August 1992, the SIF is funded by a 5.4 percent payroll deduction from every worker. The SIF is intended to fund child care, maternal care benefits, and sick care. Generally, 74 percent of revenue collected from the SIF contributions remains with the enterprise while the remainder is sent to the center to finance federal responsibilities. Workers who have accrued eight or more years of experience receive their entire salary as do Chernobyl victims, parents with three or more children, and war victims. Workers with less that five years experience receive 60 percent of their salaries while those with between five and eight years experience receive 80 percent of their salaries. It is accepted practice that benefits are paid until the worker recovers or is granted a disability pension.

Mothers receive support through a maternity grant which equals five times the amount of the present minimum wage. Additionally, working mothers receive a maternity allowance, over the span of 126 days, which is equivalent to her entire salary. When this time has elapsed, the mother can receive a payments that equals the minimum wage for up to a year and half.

The expenditure responsibility for family benefits, which generally are divided into the following broad categories: payment made to all families with children without regard to income or prerequisites, cash transfers to disadvantaged families, and payments made to working mothers, is unequally shared among all three levels of government. Although the national level contributes, it mandates the levels of benefits while often leaving it to the sub-national governments to finance the increase.

Unemployment in the region in a relatively new phenomena due to the general nature of the Soviet system. The Employment Fund was created in 1992 to pay unemployment benefits to those affected by the transition to a market economy. Contribution to the fund comes from a mandatory two percent payroll deduction and budget transfers. Revenue collected from the payroll tax is shared between the raion and oblast governments on a 45 percent to 55 percent ratio. The former then remits 10 percent to the center for federal responsibilities. Benefits, from Western perspective, are considered generous. Individuals just entering the work force receive the minimum wage. Workers who have been laid of receive in the first three months receive a cash benefit equal to 75 percent of their previous salary. The benefits level drops to 60 percent for the following six months and 45 percent for the remainder of the year.

The Fund for Social Support ( FFS) is a limited national source for sub-national funding of social programs. In 1992, the FFS accounted for only .01 percent of GDP. The stated purpose of this fund is to aid rayons that have been particularly hard hit in the transition from a command economy. The FFS began operations in 1992 with revenue from seized Party assets and tax from re-appraised inventories. It is also supposed to receive revenue form the privatization process (although it did not receive the ten percent assigned in 1992) and "receipts from the revaluation of commodities in state stores and ruble receipts from sale of food aid."

Although inflation increases revenue to the Russian government, it naturally impoverishes the population when adjustments are not made (or insufficient to deal adequately with inflation) to monetary benefits such as the minimum wage and pensions which provides the basis for the social safety net. Inflation was one of the primary causes of poverty in Russia. As chart A5 shows, social subsidies and transfers have also been ineffective because they do not reach the truly needy. The primary reason for this economic waste is the lack of means based testing.

The problem of hyper-inflation which had plagued Russia earlier in the transition period has been replaced" by the dramatic reduction in real wages and severe dilemma of arrears. By December 1995, real wages declined by 13 percent and real consumption declined by 5.3 percent. Real wage decline, and unexpectedly low levels of unemployment, can be attributed to evasion of excess wage tax and inside the gate employment" by which enterprise managers hoard labor by paying minimum wage and compensation workers in non-taxable manners such as payment in kind, low interest long-term loans that have questionable repayment terms. It should be noted that the Pension Fund is becoming more experienced in detecting methods of tax avoidance and recent action has been taken to close loopholes

Reduced inflation has given way to arrears as one of the primary causes of poverty in the Russian Federation and has primarily been the result of international pressure to reduce the budget deficit by ending emission based methods of covering the deficit" and tax avoidance and evasion. According to ITAR-TASS, pensioner were owed nearly 3 billion dollars in October 1996. Revealing the revenue gap, 22 regions were able to make pension payments while the remaining 69 needed transfers from the federal fund. Wage arrears for both private and public sector were estimated at 43 trillion rubles--9 billion of which was the state's responsibility.

An area of concern which was not addressed in 1992 and continues to be a problem today is a rapidly deteriorating income distribution between the regions of the Russian Federation. The disparities between the rich and poor regions could possibly be the worst amongst all the federations.

CONCLUSION AND SUGGESTIONOne of the greatest obstacles to successful Russian market economic development is the absence of a modern and effective tax system and lack of reliable data. Foreign capital always seeks predictability, especially in terms of projecting tax liabilities. Lack of a stable tax regime is the number one reason why Russia's direct foreign investment dollar level is so low compared with other emerging markets. A frequent and common concern expressed by foreign companies is the fear (whether real or perceived) of an unstable, inequitable, unreliable, and unpredictable tax system in Russia. As a result, capital that could potentially be invested in Russia is instead invested in other countries that are perceived as enjoying more stable tax systems. For Russia, it is time to introduce tax breaks or other incentives by the end of the year for companies using international accounting methods as part of a new business reform plan. For example, companies which would follow these (international accounting) standards will have their profit tax lowered by, say, five percent... or maybe they will receive other privileges. Most Russian companies use domestic accounting practices developed to calculate tax levels. Western accountants say Russian accounting has limited use for business planning and investment. Below, we have stated some suggestion and concerns regarding public finance in transitional economies:

Before making any changes in the tax system the officials have to think very carefully to avoid unplanned changes. For instance, the law on the VAT has been changed 13 times since it was enacted. Proper tax reform would also solve another of Russia's problems--its chronic budget deficit. The country's inadequate system of tax revenue collection has been unable to keep pace with the rise in government expenditure, leading to a budget deficit of 6.3 per cent of GDP in the first half of this year. According to Mr. Stuart Brown, eastern Europe economist at Paribas Capital Markets, while fiscal policy has been lax in Russia, monetary policy has had to bear the burden of reducing inflation. The result has been high real interest rates. No wonder then that several leading companies are looking abroad for capital. Reducing the budget deficit, to reduce "crowding out" at home and allow fiscal policy to take some of the burden in controlling inflation, must therefore be a priority for the Russian government. The problem is that tax evasion and a culture of non-payment in Russian industry, will hamper efforts to improve revenue collection.

Regulate the movement of budget money by reorganize the Russian treasury and concentrate all budgetary financial flows within it.

A good approach to battling non-compliance would be the implementation of a unified computer information system to control revenues and expenditures of the federal budget and state extra-budgetary funds, which should contain taxpayers registration system and bring together information on tax and customs duties payments, banking transactions and cash disbursements, as well as data on tracing and utilization of the federal budget resources. But it is still difficult to implement. First, Russia does not have high qualified specialists in database and management information systems (MIS). Second, it will require buying expensive mainframe computers what is critical under collected (60 percent - percent) revenue. It is also important to decide what kind of tax information is going to be the first to be put in the database. The State Tax Service of the Russian Federation recently began this process by requiring all taxpayers to indicate a personal taxpayer identification number (PTIN) on payments and settlement documents for taxes and other levies beginning on August 1, 1995. The rule as of January 1, 1996, states that a PTIN should be included on all payment and settlement documents. Also Russia's State Taxation Service is redoubling its efforts to stop commercial banks from hiding income from tax authorities. The taxation service recently found that credit institutions failed to transfer 3 trillion rubles to the state on time, and that they have used legal means to hide their income. With the centralized computer tax information system, it would be easier to observe taxpayers and prevent tax evasion.

Reduce the cost of servicing the state debt. Stop the emission of money. Improve control over monopolies. Reorganize the banking system. Set up a federal deposit of insurance bond. Reform ministry of finance and economy. Diversification of the tax base.Some services should be financed by taxes levied on local beneficiaries. "Local taxes" are those over which local authorities have some control. Which taxes to assign? The question is not easy for Russia. In many market economies, the central government controls those taxes considered to be most redistributive, such as personal income taxes, and the cyclical corporate income tax, leaving more stable revenue sources levied on a consumption base or property to the local level. For example, some federal systems (the U.S., Switzerland, Canada) allow subnational corporate taxes, it would be better for the federal government to set the corporate income tax. For the transition economies, considerations of both administrative complexity and allocative efficiency suggest that subnationally levied corporate taxes should be avoided at the present time. Permitting the many small subnational governments in the transition economies to set corporate tax rates (or adjust the tax base) will allow substantial tax competition and differentiation in enterprise taxation, influencing enterprise location decisions in perhaps undesirable directions.

.The development of a more efficient and effective social safety net in perhaps the most immediate and difficult task to accomplish in the Russian Federation. Aside from cultural reasons outlined earlier, economic growth cannot occur without social stability which will not happen until Russia can design an effective system of coverage. Some possible ways to improve this critical area are: diversify the tax base for social programs, redesign the system of federal-sub-national relation which has made the latter bear an unjust amount of the burden--unfair because of regional differences and compounded by Soviet planning--, and make stronger attempts to reduce arrears which is a difficult task due to the temptation to return to emission-based methods of covering expenditure requirements.

![]()

APPENDIX

|

| ||||||||||

| 1961-70 | 1971-75 | 1976-80 | 1981-85 | 1986-90 | ||||||

| 1. Net material product (NMP), Soviet official* | 6.4 | 5.1 | 3.9 | 3.1 | 4.1 | |||||

| 2. Gross national product (GNP), CIA estimates* | 5.1 | 3.7 | 2.1 | 1.9 | C | |||||

| 3. Gross fixed capital investment, Soviet official* | 6.9 | 6.8 | 3.5 | 3.5 | 4.9 | |||||

| 4. Industrial output, Soviet official | 8.5 | 7.4 | 4.4 | 3.7 | 4.6

| |||||

| 5. Industrial output, CIA estimates b. | 6.6 | 5.9 | 2.4 | 2.0 | C | |||||

| 6. Agricultural output, Soviet official c. | C | 2.5 | 1.8 | 1.0 | 2.7 | |||||

| 7. Agricultural output, CIA estimates b.,c. | C | 1.4 | 0.4 | (-)0.6 | C | |||||

| 8. Real income per capita, Soviet official | 6.5 | 4.3 | 3.4 | 2.1 | 2.7 | |||||

| 9. Consumption per capita, CIA estimates b. | 3.8 | 2.9 | 2.0 | 1.9 | C | |||||

|

a. Utilized for consumption and accumulation. | ||||||||||

|

| ||||||||||||

| USSR | US | FRG | France | Italy | UK | |||||||

| 1961-65 | 4.8 | 4.6 | 4.8 | 5.8 | 5.2 | 3.2 | ||||||

| 1966-70 | 5.1 | 3.2 | 4.2 | 5.4 | 6.2 | 2.5 | ||||||

| 1971-75 | 3 | 2.2 | 2.1 | 4 | 2.4 | 2.2 | ||||||

| 1976-80 | 2.3 | 3.4 | 3.3 | 3.3 | 3.8 | 1.6 | ||||||

| 1981-85 | 1.9 | 2.4 | 1.3 | 1.1 | 0.9 | 1.9 | ||||||

| Note: US GNP calculated in 1982 prices. GNP growths of FRG, France, Italy and UK are calculated from GDP in 1980 prices. | ||||||||||||

| Source: Cohn (1987, p. 12) Authors' Source: Elliot and Dowla in International Journal of Social Economics" v. 21 p. 78 | ||||||||||||

|

| ||||||||||||

| Type of expenditure | 1985 | 1986 | 1987 | 1988 | 1989 | 1990 | ||||||

| In billions of rubles (nominal) | 386.5 | 417.1 | 430.9 | 459.5 | 482.6 | 488.2 | ||||||

| Consumer subsidies | 58.0 | 65.6 | 69.8 | 89.8 | 100.7 | 110.5 | ||||||

| Food subsidies | 56.0 | 58.0 | 64.9 | 66.0 | 87.7 | 95.7 | ||||||

| Social insurance and health care | 83.6 | 89.3 | 94.5 | 102.5 | 105.5 | 117.2 | ||||||

| As percent of GNPConsumer subsidies | 7.5 | 8.2 | 8.5 | 10.3 | 10.9 | 11.6 | ||||||

| Social insurance and health care | 10.7 | 11.2 | 11.5 | 11.7 | 11.4 | 12.3 | ||||||

|

| ||||||||||||

|

| ||||||||||||

| Very | Poor | Poor | Not | Poor | ||||||||

| Transfer | % Receiving the benefit | Avg % of Recipient Household Income | % Receiving the benefit | Avg. % of Recipient Household Income | % Receiving the benefit | Avg. % of Recipient Household Income | ||||||

| Family Allowances | 288.8 | 23.6 | 32.4 | 14.5 | 25.7 | 5.9 | ||||||

| Pensions | 0.3 | 75 | 41 | 66.9 | 48.7 | 58.4 | ||||||

| Unemployment Benefit | 0.8 | 21.7 | 0.4 | 17.8 | 0.3 | 9.8 | ||||||

| Subsidies from Local Authorities | 100.4 | 9.6 | 10.4 | 9.6 | 14.5 | 8.1 | ||||||

| Subsidies from Enterprises | 55 | 9.4 | 8.7 | 10.8 | 17.7 | 11.7 | ||||||

| Scholarships | 50.2 | 17.8 | 6.2 | 18.2 | 6.7 | 8.7 | ||||||

| All Transfers* | 666.8 | 58.5 | 70.9 | 48.4 | 74.4 | 42.6 | ||||||

|

Source: RLMS. Round 4. October 1993- February 1994. | ||||||||||||

A6 List of Goods in Everyday Demand and Services to the Population which are Exempt from the Sales Tax

Children's food, meat, meat products (except delicatessen products), milk and milk products, margarine, fats, bakery products, flour, pasta products, eggs, tea, sugar, salt, vegetables (cabbage, carrots, beet, onions, potatoes),fish and fish products, vegetable oil, mineral water, children's items, textbooks for general education schools, specialist educational and medical equipment and medical supplies;

Children's items, including clothing, footwear, furniture, bed-linen, school uniform, toys and sports items; Consumer goods on lists approved by the councils of ministers of the republics within the USSR, kray soviet executive committees, oblast soviet executive committees, Moscow and Leningrad city soviet executive committees and executive committees of autonomous oblast and autonomous okrug soviets of people's deputies;

A7 USSR: SALES TAX DECREE Full text of instruction issued by USSR Ministry of Finance and dated February 11, 1991 ). The provisions include some of the following:

1. Liability extends to joint ventures and Soviet organizations engaged in importing;

2. Joint ventures will pay tax on hard currency sales in rubles, converted at the prevailing commercial rate of exchange fixed by USSR Gosbank;

3. Liability extends over a wide range of supply, including professional, informational, communication, etc. services;

4. The tax rate is 5%;

5. Tax exemption applies to sales of precious metals, coal shale, export services, trade between parts of a constituted enterprise.

SOURCE: EKONOMIKA I ZHIZN February 23, 199. P19

A8 Taxable income received in calendar year. Source: Tax 96 TNI 4-1 (Foreign Taxation) (Doc 96-947)

less than 12 million Rubles 12 % from 12 million Rubles 1, 44 million Rubles +to 24 million Rubles 20 % of the sum exceeding 12 million Rubles from 24 million Rubles 3.84 million Rubles to 36 million Rbls, 25 percent of the sum exceeding 24 million Rubles above 48 million Rubles 10.44 million Rubles + 35 percent of the sum exceeding 48 million Rubles

![]()

1. Isaak I. Dore , 1995 Distribution of Governmental Power Under the Constitution of Russia" in Parker School Journal of Eastern European Law" v. 2 p. 675

2. ibid p. 681

3. ibid p. 865

4. ibid p. 691

5. ibid p. 678

6. ibid p. 688

7. With the current political situation we can say that the budget as a whole, without doubt, will not pass the Duma by the end of the year.

8. The Moscow Times May 21, 1996. p. 54.

9. World Paper. September, 1996 p. 33

10. TNI 73-22, 1996

11. TNI 22/16, 1992, John Turro

12. Joint Letter No VG-4-12/25N of June 16, 1995

13. Doc 96-947

14. Much of the literature on tax assignment argues that the personal income tax(PIT), generally one of the more important taxes in revenue terms, should be retained by the central government, largely for redistributional and stabilization reasons. Nevertheless, the central government may give local governments a share in the PIT.

15. Tax Analysts, Tax Notes International. January 25, 1993

16. NOVECONCOMMERSANT. July 28, 1994. p. 2

17. In Russia, this tax is mostly levied at a national level because of the administrative convenience, these taxes have been levied at the producer level, not the retail level; and in the transition economy context this often translates into a tax on a few manufacturers as in Russia, for example, there are cigarette factories in only 21 of its 2000 "raions" (Comparative Economic Studies Winter 1994, Vol. 36, No. 4), or sometimes on the single monopoly producer. Thus, only a few producing districts would benefit from levying these taxes and revenues from them would accrue to only a few localities

18. Tax Analysts, Tax Notes International. January 25, 1993

19. Tax Analysts, Tax Notes International. January 25, 1993

20. Tax Analysts, Tax Notes International.January 25, 1993

21. The British Broadcasting Corporation March 15, 1991

22. Scot Antel. The Moscow Times. May 21, 1996

23. Though temporary steps were made like creating special colleges that are attached to courts of arbitration, we suppose that creating a special tax courts is essential here

24. Of course, taxes existed but people could not evade them as they were centralized and in theory all means of production were owned by the state.

25. Washington Post. October 12, 1996. p. A25

26. But we are afraid that this provision will not benefit the economy

27. Betsy McKay. The Wall Street Journal.October 29, 1996. p. A12

28. Comment & Analysis; Statistics; Forecast; November 1996 p. 2

29. Information Services Quest Economics Database Credit Suisse Financial Forecast, 1996

30. Reuter Textline Reinsurance, October 31, 1996

31. In our opinion, inflation will come down further in 1997, to approximately 15 percent. Also, Russia continues to fail in its economic performance of it fiscal and monetary policy within the framework established by the International Monetary Fund.

32. The Moscow Times. March 27, 1996

33. Dmitry Falcovich, head of the macroeconomic department with Alliance-Menatep

34. Russian Federation: Toward Medium-Term Viability. 1996. IBRD/World Bank p.39

35. Fiscal Management in Russia. 1996. IBRD p. 39

36. Fiscal Management in Russia. p. 22

37. John E. Elliot and A.F. Dowla. Gorbachev, Perestroika and Democratizing Socialism" in International Journal of Social Economics" v. 21 p. 78

38. Linda J. Cook. 1995 The Soviet Social Contract and Why It Failed." Harvard University Press: Cambridge p.2 Cook suggests the following as empirical evidence: 1. That the Soviet regime consistently deliver to workers economic security and social welfare; 2. That the regime deliver these policy goods because it is constrained by it perception of workers' expectations or its fear of labor discontent if it fails to deliver them; [and] 3. that workers give in exchange political compliance and quiescence. p. 5

39. Vladmir Mau. 1996 The Political History of Economic Reform in Russia, 1985-1994. Center for Research into Communist Economies p. 59

40. John Dunlop. 1993. The Rise of Russia and the Collapse of the Soviet Empire. Princeton University Press: Princeton. p. 267

41. Cook p.141

42. ibid p.187

43. Thomas A. Mroz and Barry M. Popkin. 1995. Poverty and Economic Transition in the Russian Federation" in Economic Development and Cultural Change . V 44 p.3

44. ibid p.4

45. ibid p. 4

46. Russia: Social Protection During Transition and Beyond International Bank For Reconstruction and Development Report No. 11748-RU. p. 23

47. Vladimir Mikhalev Social Security in Russia under Economic Transformation" in Europe-Asia Studies v. 48 n.1 (note: As this source came from an electronic medium, I have omitted page numbers--DL)

48. ibid

49. IBRD Report No. 11748-Ru. p. 35

50. ibid p. 11

51. EBRD p. 40

52. ibid

53. BISNIS Country Report

54. OMRI November 31, 1996

55. OMRI October 4, 1996

56. Financial Times. September 23, 1996

57. Of course, it is possible to lower administrative costs and improve overall efficiency in the tax system by going to a more computerized system but resistance to change due to unquestionable job loss is quite evident in the Russian government.

58. Komsomol'skaya Pravda. Sept. 24, 1996

![]()

The file was preapred by Dmitri Maslitchenko dmitri@mailroom.com

Похожие работы

onomic relations between the European Union countries and Russian Federation. Steps to be followed: 1.To identify stereotypes that influence economic relations between EU and Russia. 2.To find out consequences of influence of stereotypes on economic relations between EU and Russia. 3.To find out a possible solutions for the problem of negative influence of stereotypes. 4.To investigate ...

... to meeting you, I remain Sincerely yours Gennady Bogachev Deputy DirectorTask III. Conversation on the topic of your thesis аспирантура (канд. экз.) Экзаменационный билет (на 2 листах) по дисциплине английский язык (специальность: социальная философия) билет №2 Task I. Translate from English into Russian in writing using a dictionary. Your time is 45 minutes The book opens with a broad ...

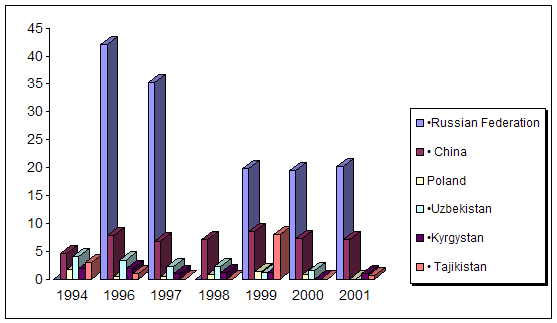

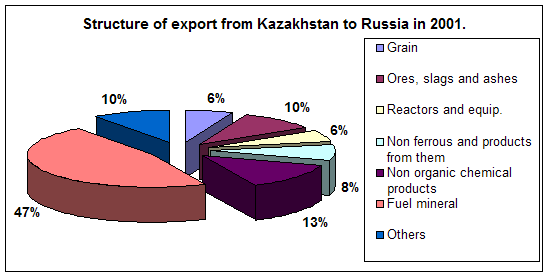

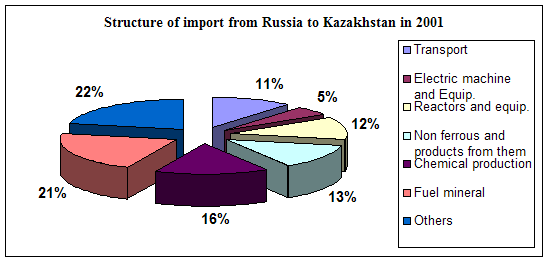

... course of republic. A complex of the reasons conditions and factors having not tactical, but basic essence and long-time character stipulates it. Today common balance of mutual relation between Kazakhstan and Russia has positive character, as consider each other as the strategic partners and it establishes the important premise for their mutual cooperating in the field of policy, economy, ...

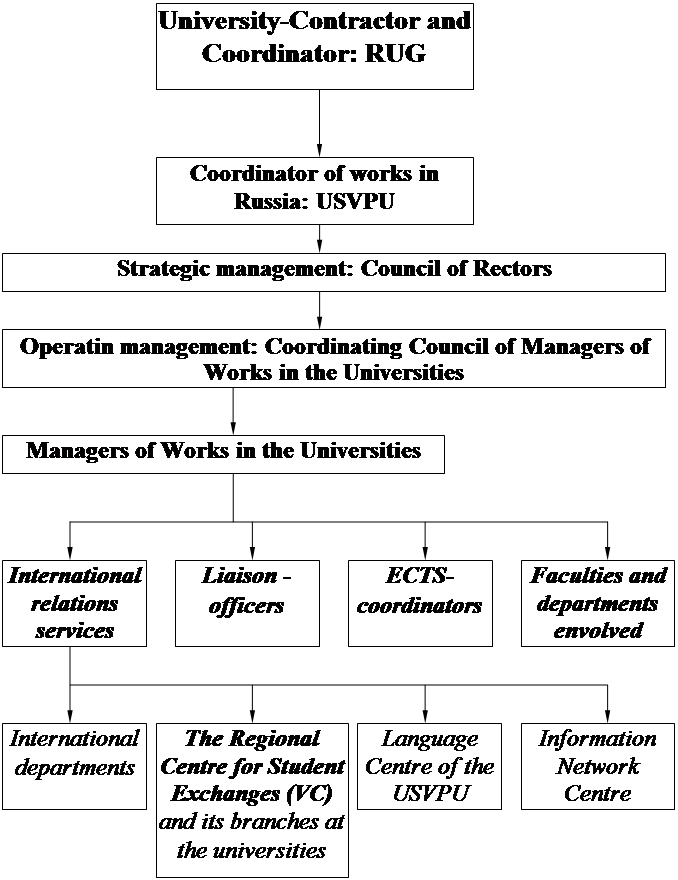

... allow to operate and to realize these programs successfully. Mrs. Lieve Bracke has been acting as the coordinator of student exchange programs between the Santander group universities ICP-94-NL-2020/17, joint European projects on student exchanges with Hungary (in several specialities) and pre-project Pre-JEP 00304-93 with Kiev University (Ukraine), in which university of Leeds (Great Britain) ...

0 комментариев